You see the top performers on the sales floor move into that coveted office. You hear the whispers of six-figure paychecks. But what does a finance manager car dealership professionals rely on actually do all day? For many ambitious salespeople, the F&I office is a black box-a high-stakes, high-pressure world that seems both intimidating and confusing. You’re ready for the next step in your career, but you’re unsure if your skills match the job or how to navigate the path from sales to finance success.

It’s time to unlock your potential. This is your all-access pass inside the F&I office. We’re pulling back the curtain to reveal a minute-by-minute breakdown of this sought-after career, from structuring the first deal of the morning to closing the last customer at night. You will discover the real challenges, the critical skills you need to master, and the roadmap to achieving the high-income rewards. Get ready to determine if this powerful career path is the right fit to accelerate your future.

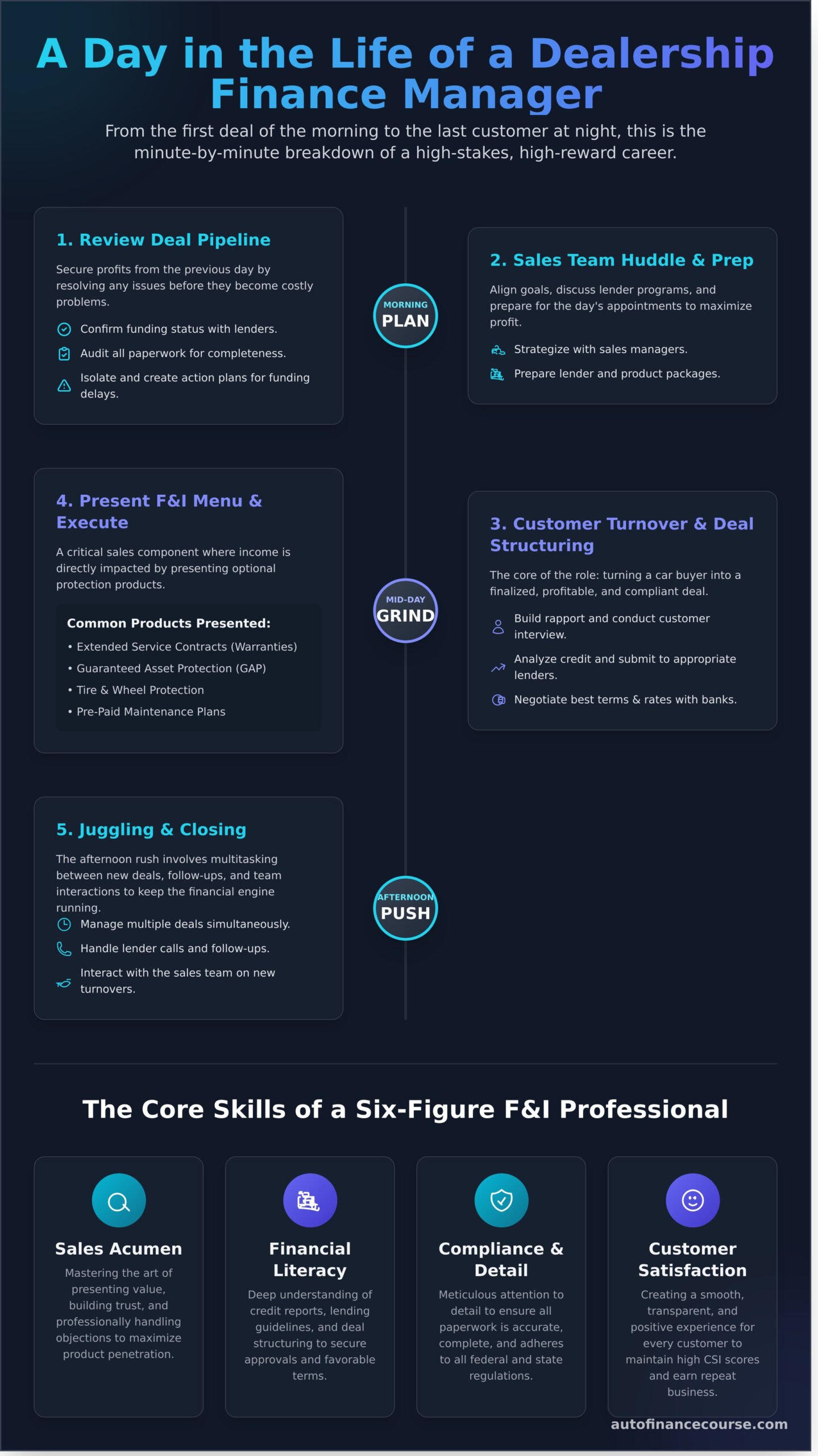

Long before the showroom doors unlock, the day has already begun for a high-performing finance manager car dealership professionals trust. The Finance & Insurance (F&I) office is the dealership’s financial engine room, and a successful day is built on a foundation of meticulous morning preparation. This isn’t about reacting to deals as they come; it’s about proactively engineering a profitable and compliant workflow. Mastery of the morning routine is the first step toward unlocking your maximum income potential.

The first order of business is securing the profits from the previous day. This critical review involves a tactical sweep of all pending deals to ensure cash flow remains strong and contracts in transit (CIT) are minimized. The goal is to identify and resolve any issues before they become costly problems.

Success in F&I is a team sport. The morning huddle with sales managers is essential for aligning goals and strategy. This brief but powerful meeting sets the tone for the entire day, transforming sales appointments into profitable deliveries. You will discuss current lender programs, interest rate specials, and review the list of expected vehicle deliveries to prepare a tailored F&I presentation for each customer, maximizing product penetration and CSI scores.

An organized F&I office is a profitable one. With the day’s appointments in mind, the final step is preparing all necessary documentation. A key part of this is a deep understanding of the entire car financing process, from credit applications to final contracts. This means organizing contracts, ensuring all compliance forms are current, and reviewing the inventory of ancillary products like service contracts and GAP insurance. When a customer enters your office, every tool you need to close the deal efficiently and compliantly must be at your fingertips.

Once the morning prep is complete, the real action begins. This is where the core responsibilities of a finance manager car dealership come to life. The mid-day grind is a high-energy, fast-paced mix of finance, strategic sales, and expert customer service. Each customer walking into your office presents a unique puzzle. Your mission is to finalize their vehicle purchase while structuring a deal that maximizes profitability for the dealership. This is where you unlock your true earning potential.

After the salesperson secures a commitment, the customer is “turned over” to you. This is your stage. The first step is to build immediate rapport and trust, transitioning the customer’s excitement into a professional financing discussion. You will verify their information, understand their budget and driving habits, and clearly explain the financing process. Setting clear expectations is crucial for a smooth transaction. For a complete breakdown of this pivotal role, see our guide on what an F&I Manager is.

With the customer’s application in hand, you become a financial strategist. You’ll analyze their credit report, assess their financial standing, and submit the deal to the most appropriate lenders in your network. This often involves direct negotiation with bank representatives to secure the most favorable interest rates and terms. A top-tier finance manager car dealership excels at overcoming credit challenges, finding creative solutions to get even tough deals approved and funded.

This is a critical sales component of the role where your skills directly impact your income. You will present a “menu” of optional protection products, clearly explaining the value and peace of mind each one offers. Your goal is to help customers protect their investment with products like:

Mastering this presentation and professionally handling customer objections is a skill that separates the highest earners from the rest.

Once the deal structure and products are agreed upon, it’s time to execute the contracts. Precision is non-negotiable. You will print all legal documents, meticulously review them for accuracy, and guide the customer through the signing process, ensuring every signature and initial is perfect. This demands a strict adherence to legal and regulatory compliance, a core responsibility outlined by sources like the U.S. Bureau of Labor Statistics, which details the high standards and positive job outlook for financial managers who master these duties.

While the morning may focus on face-to-face customer interaction, the afternoon is where a top-performing finance manager car dealership truly demonstrates their mastery of multitasking. This is not about handling one deal at a time; it’s about managing a portfolio of responsibilities that directly fuel the dealership’s cash flow and profitability. Your ability to shift gears seamlessly between administrative follow-up, strategic relationship building, and sales support is what unlocks your highest income potential.

A signed contract is a promise of profit, but cash in the bank is what matters. A critical afternoon task is ensuring every deal gets funded without delay. This involves proactively calling lenders to resolve any “contracts in transit” (CIT) issues, such as missing stipulations or paperwork. Every day a contract sits unfunded is a day the dealership’s capital is tied up. Mastering this process ensures a healthy cash flow, making you an indispensable asset to the business.

Your network of lenders is one of your most powerful tools. The afternoon often includes calls and visits from local bank and credit union representatives. Building these strong partnerships is essential for getting tough deals approved and securing the best possible terms for your customers. This focus on strategic communication is a core skill; in fact, the Financial Manager Job Outlook from the U.S. Bureau of Labor Statistics highlights such duties as vital for overseeing an organization’s financial health. Strong lender relationships give you the leverage to turn a potential “no” into a definitive “yes.”

An expert F&I manager is the engine of the sales department. Throughout the afternoon, you act as the central command for deal structuring and profitability. Your support includes:

This active support empowers the sales team, increases closing ratios, and maximizes the gross profit on every single vehicle sold.

Success in the F&I office isn’t about processing paperwork-it’s about driving profitability. While anyone can learn to fill out a form, the highest earners in this lucrative career master a unique blend of hard and soft skills. These are the core competencies that separate an average employee from an elite professional. Are you ready to see what it takes to reach the top?

The abilities that define a top-tier finance manager car dealership professional are not accidental; they are developed, honed, and perfected. They are the engine of a high-income career.

This is where potential is unlocked. A top F&I manager presents financial products with absolute confidence, clearly articulating their value to the customer. They are expert negotiators, securing favorable terms from lenders while structuring deals that benefit both the customer and the dealership. Mastering the art of overcoming objections without high-pressure tactics is crucial for maximizing income and maintaining high CSI scores.

In the world of automotive finance, a single mistake can cost the dealership thousands of dollars in fines, chargebacks, or legal fees. Elite F&I managers are obsessed with accuracy. They ensure every signature is in place, every number is correct, and every legal document is 100% compliant with complex federal and state laws. This precision protects the dealership and builds a foundation of trust.

The F&I office is a high-stakes environment. You will face demanding customers, tight deadlines, and the pressure of being the dealership’s profitability hub. The best managers thrive under these conditions. They handle stressful situations with unshakable calm, juggle multiple deals simultaneously, and maintain a positive, solution-oriented attitude through long and demanding hours. This resilience is non-negotiable for success.

The automotive industry never stands still. Compliance laws, lender programs, and available products are in a constant state of change. A top-performing finance manager car dealership professional is a lifelong learner, committed to continuous education to stay ahead of the curve. They understand that investing in their skills is the only way to guarantee long-term success and income growth. Mastering these essential skills is precisely what our F&I Manager Course is designed to help you achieve.

You’ve seen the fast-paced, high-stakes environment of the F&I office. Now, the real question is: Do you have what it takes to succeed? A career as a finance manager car dealership is not for everyone. It demands resilience, sharp negotiation skills, and a relentless drive for success. But for the right individual, it is a direct and proven path to a six-figure income and a position of significant influence.

To decide if this high-octane career is your future, you must weigh the incredible rewards against the undeniable realities of the role.

This isn’t just a job; it’s a powerhouse role. F&I Managers are consistently among the highest-paid professionals in any dealership, with income potential directly tied to performance. You are the profit center, the expert who structures the deals that drive the bottom line. This level of responsibility commands respect and makes you a critical player in the dealership’s overall success and profitability.

The high rewards come with equally high demands. A typical day often stretches into evenings and weekends-you work when customers are buying cars. The pressure to perform is constant, with your results in profitability, compliance, and customer satisfaction under a microscope. This high-stakes environment requires a cool head, unshakable confidence, and an elite work ethic to truly thrive.

Are you ready to meet the challenge? The demand for a skilled finance manager car dealership teams rely on is unwavering. With expert training, you can master the skills needed to become a top performer that dealerships are actively seeking. You don’t have to guess your way to the top; there is a clear roadmap to success.

Your journey starts with the right investment in your potential. Explore our ultimate guide to Finance Manager Training and build your high-income career today.

As you’ve seen, a day in the life of a finance manager car dealership is a high-octane blend of strategy, salesmanship, and intense focus. It’s about more than just processing loans; it’s about maximizing profitability on every single deal and navigating complex customer interactions under pressure. This sought-after position is the financial command center of the dealership, demanding a unique set of skills to succeed.

If this challenge excites you, it’s time to invest in your potential. Our training is built from real F&I office experience to give you the exact roadmap you need. We empower you to master the skills to start a high-income career and become a confident, job-ready F&I manager from day one. Are you ready to drive your future forward? ENROLL NOW in Our Online Course! Your future in the fast lane starts today.

The greatest challenge is managing intense, constant pressure from multiple directions. You must meet aggressive profitability targets, maintain strict legal compliance, and achieve high customer satisfaction scores, often all at once. Mastering this high-stakes environment requires resilience and an expert skill set. Top performers thrive on this pressure, turning it into a catalyst for achieving a high-income career and becoming an indispensable asset to the dealership’s success.

No, a college degree is not a prerequisite for success in this role. Dealerships prioritize proven skills, a strong work ethic, and a track record of performance. Your ability to structure deals, understand compliance, and drive profitability is far more valuable than a diploma. Specialized F&I training is the fastest path to acquire the dealership-ready skills you need to unlock your full potential and secure this sought-after position.

The role relies on financial strategy, not advanced mathematics. You must have a solid grasp of basic arithmetic to calculate payments, interest rates, and profit margins. However, most complex calculations are handled by specialized dealership software. Your real skill is in understanding the numbers to structure profitable deals and clearly communicate financing options to customers, turning complex data into a successful sale.

Mastering the F&I office is a direct pipeline to senior leadership. A top-performing finance manager car dealership is perfectly positioned to advance to roles like Sales Manager, General Sales Manager (GSM), or even General Manager. Because you develop an expert understanding of dealership profitability, compliance, and sales operations, you become a prime candidate for running the entire store. Your career potential is limitless.

An expert F&I manager views a customer with bad credit as an opportunity, not an obstacle. The key is to leverage a strong network of subprime lenders and master the skills needed to structure a deal that gets approved. This involves finding the right vehicle, down payment, and financing terms that satisfy the bank, the dealership, and the customer. Solving these challenges is a critical skill that directly boosts your income.

The role demands long hours, especially at the end of the month, as it is directly tied to the dealership’s sales rhythm. This is a high-performance, high-reward career. The schedule is an investment in your financial future, with your income potential directly reflecting your commitment. While not a typical 9-to-5 job, the significant financial freedom it provides is a trade-off that many ambitious professionals are eager to make.

Already have an account? Login