Are you ready to unlock the next level of your automotive career? You see the top earners and know there’s more potential than just selling on the floor. But the path to becoming a high-performing auto dealer finance manager feels unclear. You’ve heard the stories of six-figure incomes, but the rumors of high-pressure deals and complex legal rules make you hesitate. How do you make the leap from the sales desk to the F&I office, and what skills do you really need to master?

This is your definitive roadmap to success. In this ultimate guide, we cut through the noise to give you the facts. You will discover the core daily responsibilities, get a transparent look at the powerful salary and commission structures, and learn the exact skills that separate top F&I producers from the rest. Consider this your action plan to build a high-income career and secure one of the most profitable and sought-after positions in any dealership.

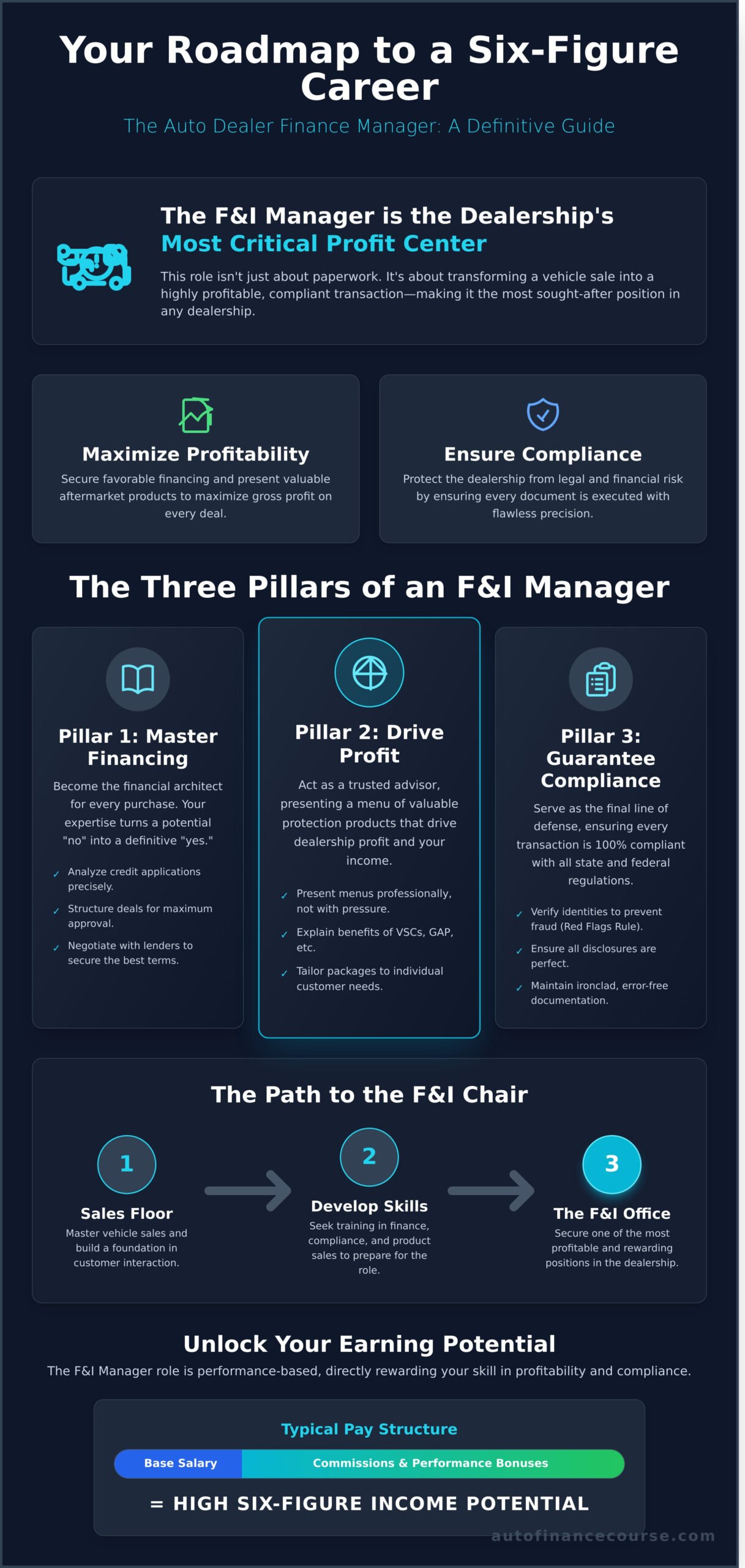

Most people think a car sale ends when the customer agrees on a price. That’s where they are wrong. The most critical and profitable part of the transaction is just beginning, and it happens in the office of the auto dealer finance manager. This isn’t just a paperwork-pusher; this is the dealership’s financial quarterback, the expert who transforms a simple vehicle sale into a highly profitable deal.

While a salesperson focuses on selling the car, the Finance & Insurance (F&I) Manager structures the financial agreement that makes the purchase possible. They are the masters of profitability and the gatekeepers of compliance, a pivotal role within the complex ecosystem of modern Car Dealership Operations. This unique position is why the F&I office is universally known as the dealership’s primary profit center and why it represents the ultimate high-income career path in retail automotive.

An elite F&I Manager operates with two primary objectives. The first is to maximize the gross profit on every single vehicle sold by securing favorable financing terms and presenting a menu of valuable aftermarket products. The second, equally crucial, is to protect the dealership from devastating legal and financial risk by ensuring every document is executed with flawless precision. Mastering this balance between aggressive profitability and ironclad compliance-all while maintaining a high Customer Satisfaction Index (CSI)-is the hallmark of a top performer.

The F&I Manager is the final, essential touchpoint in the customer’s journey and the key to unlocking a dealership’s full potential. Their success is built on a foundation of critical skills and responsibilities:

This powerful combination of finance, sales, and legal expertise is what makes the role so challenging and rewarding. To dive deeper into the daily responsibilities and career path, you can learn more about what is an F&I Manager and the skills you need to master.

To unlock your highest earning potential, you must understand that the F&I role is not one job-it’s three expert roles combined into one powerhouse position. A successful auto dealer finance manager is a master of Finance, Products, and Compliance. These three pillars work in perfect harmony to transform a standard vehicle sale into a secure, profitable, and legally sound transaction. Your ability to expertly navigate these responsibilities during the customer handoff from the sales team is what separates top earners from the rest.

Mastering this trifecta requires a repeatable, organized process. Let’s break down the core functions you will master.

This is where the deal takes shape. Your first responsibility is to become the financial architect for the customer’s purchase. This involves a precise, expert process: analyzing credit applications, structuring deals with the right term and down payment, and strategically submitting them to your network of lenders. You don’t just accept the first approval; you negotiate with banks to “buy the rate” and secure the best possible terms, a skill reflected in the high earning potential detailed in Financial Manager Salary Data from the Bureau of Labor Statistics. This pillar builds the foundation for a profitable deal.

Once financing is secured, you shift into the role of a trusted advisor. This is the dealership’s primary profit center and a direct driver of your personal income. You will learn to professionally present a “menu” of valuable protection products to every customer. This includes explaining the real-world benefits of Vehicle Service Contracts (VSCs), GAP insurance, and other ancillary products. The key to success is not pressure; it’s about listening to customer needs, overcoming objections with confidence, and tailoring a package that protects their investment and provides peace of mind.

This pillar is your shield. It protects you, the customer, and the entire dealership from costly legal and financial risk. An elite F&I manager operates with unwavering attention to detail, ensuring every transaction is 100% compliant. This includes verifying identities to prevent fraud under the Red Flags Rule, ensuring all documents are perfectly executed, and adhering to a complex web of federal and state laws like the Truth in Lending Act (TILA). Maintaining meticulous, audit-proof records isn’t just paperwork-it’s the bedrock of a long and successful career.

The role of an F&I Manager is one of the most lucrative positions in a dealership for one simple reason: your income is tied directly to your performance. This isn’t a job where you wait for an annual raise. It’s a high-stakes, high-reward career where the skills you master today directly impact your paycheck tomorrow. Are you ready to take control of your earning potential?

Your compensation is a powerful blend of multiple income streams. Unlike a flat salary, an F&I pay plan is designed to reward profitability. The core components include:

Most pay plans involve a “draw,” which is a base amount paid against your future commissions, ensuring a steady income floor while you build your pipeline.

While industry averages for an auto dealer finance manager hover around $140,000 per year, this figure only tells part of the story. The top 10% of F&I professionals consistently earn over $250,000 annually. What separates them? It’s a combination of skill, the sales volume of the dealership, and location. Top performers don’t just get lucky; they are masters of a repeatable, profitable process.

There is a direct, undeniable line between your skills and your income. Our course is built around this principle. When you master the art of negotiation with banks, your finance reserve increases. When you perfect your presentation skills, your product penetration-and your commission-skyrockets. By developing an efficient and compliant process, you can handle more customers per day, maximizing every opportunity. This is the foundation of our guide to a high-income career.

Investing in your skills is a direct investment in your future earnings. Learn how to become a top performer today.

You see the potential, you have the ambition, and you’re asking the right question: “How do I break into one of the most lucrative and sought-after positions in the dealership?” The role of an F&I Manager is the peak of a high-income career in auto sales, but the path isn’t always clear. Here is the roadmap to get you there.

For decades, the path to becoming an auto dealer finance manager has been a long climb. It typically starts on the sales floor, where you must prove yourself as a top-performing salesperson year after year. From there, you might move to a closer or assistant sales manager role, learning more about deal structure. Finally, when an F&I position opens up-which can take years-you might get your shot. It’s a path of patience, politics, and waiting for an opportunity.

Whether you take the long road or the fast track, success in the F&I office is non-negotiable and built on a foundation of elite skills. You must be an expert performer who can command the room and the numbers. The most critical skills include:

Why wait years hoping for a chance? Learning on the job is slow, inconsistent, and often leads to costly mistakes that can damage your reputation and the dealership’s profitability. A structured training program is the ultimate career accelerator.

Instead of guessing, you learn a proven, repeatable process designed for maximum performance and compliance. Our comprehensive F&I training provides you with the expert knowledge, presentation skills, and confidence to bypass the long wait. It makes you an asset from day one, transforming you from a hopeful candidate into a job-ready auto dealer finance manager poised for a high-income career. Invest in your potential and claim your seat in the F&I chair faster.

The path to becoming a successful auto dealer finance manager is clearer than ever. You’ve seen how this role acts as the dealership’s profit engine and understand the immense earning potential that comes with mastering its key responsibilities. This sought-after position isn’t just a job-it’s a high-income career built on skill, strategy, and a proven process.

Are you ready to transform your ambition into action? Don’t just learn the theory-master the job-ready skills that top earners use every day. Our training is built from real F&I office experience, giving you a proven process for maximum profitability and compliance. It’s time to invest in your future and unlock a truly high-income career. Enroll in Our Online Course Today!

Your future in the F&I chair is waiting. Take the driver’s seat.

There is no single degree required to become an auto dealer finance manager. Success in this high-income career depends on mastering a specific skill set. This includes expert negotiation, a deep understanding of financing options, and strict adherence to legal compliance. Our F&I course is engineered to build these exact dealership-ready skills, providing you with the qualifications dealers are actively seeking. We give you the roadmap to become a top-performing professional and maximize your earning potential.

The F&I manager role is a high-performance position with significant responsibility, which can include pressure to meet profitability targets. However, with high pressure comes high reward and the potential for an exceptional income. Our training equips you with proven processes and expert communication skills to control the sales environment and operate with confidence. Mastering these systems transforms stress into predictable success and career momentum, putting you in command of your financial future.

The traditional path can take years of working your way up from car sales. Our intensive F&I course is designed to slash that timeline. We provide the concentrated knowledge and practical skills you need to become dealership-ready in a fraction of the time. Ambitious individuals who master our curriculum can position themselves for F&I opportunities much faster, accelerating their journey to a high-income career. Your drive and commitment determine the speed of your success.

While many F&I managers start in sales, it is not an absolute requirement. Success hinges on mastering the F&I process, not just selling cars. Our comprehensive course provides the critical foundation you need, teaching you deal structure, compliance, and product presentation from the ground up. We equip motivated candidates from diverse backgrounds, like banking or insurance, with the specialized skills to bypass the sales floor and step directly into this lucrative career path.

A sales manager’s primary focus is on the vehicle transaction-the price, the trade-in, and leading the sales team. The auto dealer finance manager takes over after the vehicle price is agreed upon. Their role is to secure financing for the customer, ensure legal compliance on all paperwork, and present a menu of aftermarket products like extended warranties. The F&I office is a dealership’s most significant profit center, and the finance manager is the expert who drives that profitability.

An F&I manager’s schedule is tied directly to the dealership’s retail hours. You should expect to work when customers are shopping, which includes evenings, weekends, and some holidays. A typical work week can often exceed 50 hours, especially during busy month-end sales events. While the hours are demanding, they are a key part of the job and are directly linked to the high-income potential that makes this one of the most sought-after positions in the industry.

Already have an account? Login