Are you ready to drive your career forward and secure a high-income, high-impact leadership role? For ambitious professionals, the position of Financial Manager represents a peak of success and profitability. But the path forward often feels unclear, shrouded in confusion about the right qualifications and the most effective steps to take. If you’re tired of uncertainty and ready for a clear-cut plan, you’ve come to the right place. This is the definitive guide on how to become a financial manager, designed to turn your career goals into reality.

We’re cutting through the noise to give you the actionable roadmap you need. Inside, you will discover the essential educational pathways, master the critical skills that top employers are searching for, and unlock the proven strategies to accelerate your career trajectory. Stop wondering and start building. This guide will give you the confidence and the expert knowledge to launch your successful career as a financial manager.

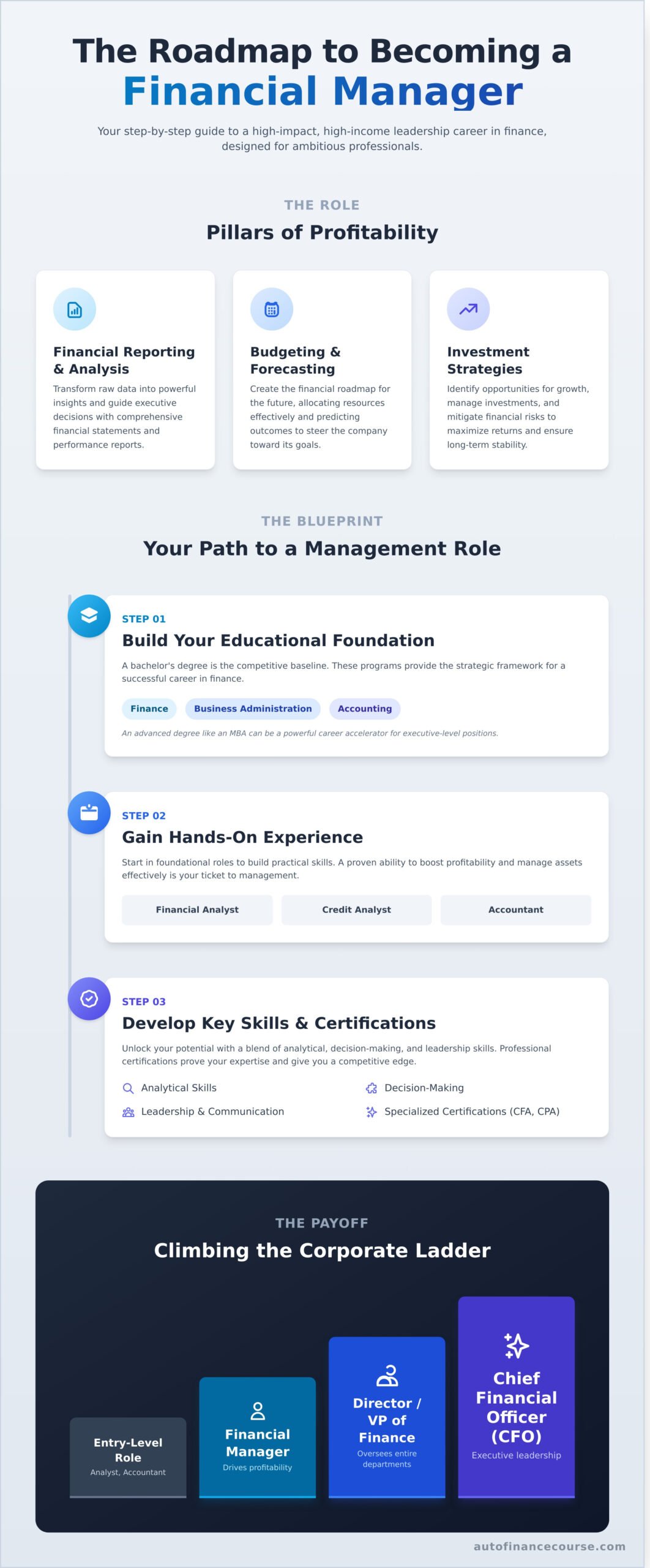

Are you ready to step into a powerful, high-income career? The first step in your journey of how to become a financial manager is to master the fundamentals of the role itself. A financial manager is the strategic engine of an organization, driving profitability and ensuring long-term financial health. They are not just number-crunchers; they are expert decision-makers who hold the keys to a company’s success and stability.

To excel as a financial manager, you must master a specific set of high-impact skills. These responsibilities are the foundation of your authority and your ability to generate results. Your expertise in these areas directly translates to the company’s bottom line and your own career potential.

Your career path is a ladder, and every step is an opportunity to increase your income and influence. Many professionals start in roles like financial analyst, credit analyst, or accountant, building foundational experience. By demonstrating a keen ability to boost profitability and manage assets effectively, you can quickly advance into a management position. Your performance is your leverage. With a proven track record, you can climb higher to roles like Finance Director, Vice President of Finance, or even Chief Financial Officer (CFO).

This sought-after role is critical across nearly every industry, from automotive dealerships and technology firms to healthcare and manufacturing. Understanding how to become a financial manager opens doors to a versatile and lucrative career where your skills are always in high demand.

Are you ready to build the foundation for a high-income career? While raw sales talent can take you far, the most successful F&I managers combine that drive with a solid educational background. Understanding how to become a financial manager in the automotive industry starts with mastering the fundamentals of finance, compliance, and business operations. This is not just about getting a job; it’s about architecting a career built for maximum profitability and long-term success.

A formal education provides the strategic framework needed to excel. While not always mandatory, a bachelor’s degree significantly enhances your credibility and opens doors to leadership roles. The most direct paths include degrees in:

For those aiming for executive-level positions, an advanced degree like an MBA can be a powerful career accelerator. According to the BLS Occupational Outlook Handbook, many financial managers hold at least a bachelor’s degree, making it a competitive baseline. Today, flexible online programs make it easier than ever for working professionals to invest in their education without pausing their careers.

In the world of finance, credentials matter. They are proof of your expertise and commitment. While designations like Certified Public Accountant (CPA) or Chartered Financial Analyst (CFA) are highly respected in broader finance, the automotive industry has its own unique demands. To truly master the F&I office, you need specialized, dealership-ready training. This is where you gain the tactical skills to structure deals, sell ancillary products, and navigate complex compliance laws. Explore our F&I Manager Course to get the focused, expert-led training designed to make you a top performer from day one.

A high-income career as an F&I Manager isn’t just handed to you-it’s earned through strategic action and hands-on experience. The path to the finance office is paved with practical skills gained in real-world settings. Your goal is to build a foundation of expertise that makes you an indispensable asset to any dealership. This is where you prove your potential and begin your journey to the top.

Are you ready to take the first step? The right entry-level position is more than just a job; it’s your training ground for mastering the skills needed for success. This is a critical part of learning how to become a financial manager who can truly drive profitability.

Gaining direct experience is the fastest way to build credibility and master the fundamentals of finance and sales. Many top-performing F&I Managers began their careers in roles that provided a deep understanding of dealership operations or financial principles. These foundational roles are critical, as experience in other financial or sales occupations is a common prerequisite noted by authoritative sources like the Bureau of Labor Statistics. Focus on positions that give you a competitive edge:

Your skills will get you in the door, but your network will propel you forward. The most successful professionals know that connections are a career catalyst. To truly understand how to become a financial manager, you must learn from those who have already achieved success. Be proactive and intentional about building relationships.

Building experience is essential, but targeted training is what separates top earners from the rest. To combine your growing experience with expert-led instruction, learn about our finance manager training programs. For more powerful career strategies, read our blog for insights and tips.

Earning a top salary as an F&I Manager isn’t just about knowing the products; it’s about mastering a specific set of high-impact skills. Your ability to analyze, lead, and communicate directly determines your potential and the dealership’s profitability. This is the difference between an average F&I professional and a true industry expert who drives results.

If you are serious about how to become a financial manager, developing these core competencies is non-negotiable. They are the engine of your success.

Top performers think strategically. They see beyond a single deal to the long-term financial health of the dealership. Mastering these skills means you can structure deals that are profitable, compliant, and secure, making you an indispensable asset.

As an F&I Manager, you are a leader at the center of the sales process. Your success depends on your ability to influence customers, collaborate with the sales team, and communicate with management. Strong communication turns challenging negotiations into profitable agreements.

Beyond these core areas, total proficiency with modern dealership software (DMS) and CRM systems is essential for peak performance. Are you ready to build the complete skill set needed for a high-income F&I career? Our expert-led training provides the roadmap to master these skills and unlock your full potential.

Your training is complete. Now it’s time to launch your high-income career. Understanding the landscape of opportunities is the final, critical step in your journey. This is where you transform your expert skills into tangible success and profitability, securing the sought-after position you’ve worked for.

A skilled F&I Manager possesses a powerful financial skillset applicable across numerous industries. While the dealership is a high-profit environment, your expertise opens doors to other lucrative sectors. Economic upswings often create more corporate finance roles, while stable sectors like insurance offer consistent demand. Your potential is not limited to one path.

Are you ready to secure a top-tier position? Your job search strategy is as critical as your training. The path of how to become a financial manager culminates in showcasing your value effectively to employers. To dominate the hiring process and accelerate your advancement, focus on these key actions:

Embarking on this career path is a significant step, but the rewards are immense. Success as a financial manager hinges on a powerful combination of formal education, strategic industry experience, and the mastery of essential leadership skills. You now understand the role, the requirements, and the vast opportunities that await a skilled financial professional.

With this complete guide on how to become a financial manager, the only thing standing between you and a high-income career is decisive action. Are you ready to stop planning and start achieving? It’s time to invest in the expert skills that drive real profitability and command respect in the industry.

Accelerate your journey with our industry-leading training. Our F&I Manager Course provides comprehensive online training built for a flexible learning schedule, with a proven record of success in helping students achieve significant career advancement. Start your journey with our F&I Manager Course today!

The opportunity to build a prestigious and lucrative career is right in front of you. Take control and unlock your full potential.

While a degree in finance or business can be an asset, it is not a mandatory requirement to become an F&I Manager. Dealerships prioritize proven sales success, a deep understanding of financing principles, and specialized training. Your ability to generate profit and maintain compliance is far more valuable than a specific diploma. The right skills and a results-driven mindset are your true keys to unlocking this high-income career path and achieving success in the F&I office.

The timeline to become an F&I Manager depends on your starting point and drive. A top-performing car salesperson can often make the transition in as little as 1-2 years by mastering the required skills. For those new to the auto industry, the path may take 3-5 years as you must first prove your sales ability. Your career velocity is directly tied to your commitment to learning the F&I process and delivering exceptional results on the sales floor.

While not always a legal requirement, professional F&I certification is essential for a fast-track career. Top dealerships demand certified professionals because it proves you have mastered critical compliance, ethics, and product knowledge. Earning a certification signals your commitment and expertise, making you a much stronger candidate. It’s a non-negotiable step in the process of how to become a financial manager who commands a top salary and the best opportunities in the industry.

To master the F&I Manager role, you must develop a powerful skill set. Key skills include: expert sales and negotiation tactics, exceptional communication for building rapport with customers, and meticulous attention to detail for handling complex legal contracts. You also need a comprehensive knowledge of finance products, lending regulations, and compliance laws. These are the core competencies that drive profitability and ensure your long-term success in this sought-after position.

The income potential for an F&I Manager is substantial and directly tied to performance. While entry-level positions may start lower, the average salary for an experienced F&I Manager in the US is typically between $120,000 and $180,000 annually. Top performers at high-volume dealerships can easily exceed $250,000 per year. This is a high-income career where your skills in sales and finance directly determine your earning power and financial success.

Transitioning into F&I from another field is a strategic process. First, leverage any existing sales or finance experience you have. Next, invest in specialized F&I training to learn the specific skills dealerships demand. The most effective path often involves starting as a car salesperson to gain invaluable dealership experience and prove your abilities. This roadmap is the fastest way to learn how to become a financial manager and secure this lucrative and powerful role.

Already have an account? Login